Quebec Mortgage Brokers

Your trusted mortgage advisors

Your trusted mortgage advisors

Orbis Mortgage Group was founded in Quebec in 2018. Having operated and grown in the province since its inception, Orbis’ Quebec brokers are uniquely positioned to serve a wide range of clients with unmatched industry knowledge, an extensive lender network, and local expertise. Our brokers serve dozens of regions across Quebec, and are ready to assist you with all your mortgage lending needs.

In keeping with our dedication to providing personalized service, and in celebration of the diversity of our team, Orbis Mortgage Group is proud to offer its services in a wide range of languages other than English and French. Please consult our brokers’ biographies below to learn more about the languages in which our services are offered.

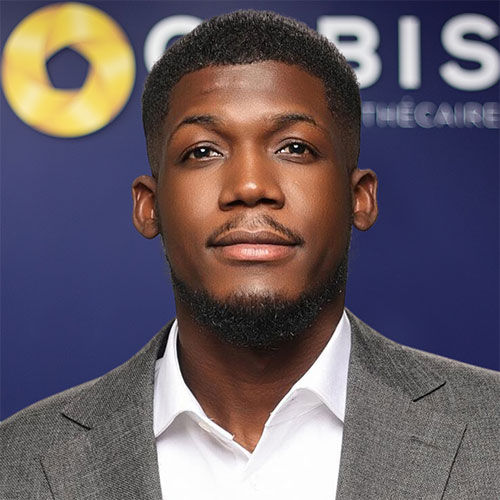

Mortgage Broker

Mortgage Broker

With interest rates still historically low, there is no better time than now to buy your first home. Let our dedicated team of mortgage brokers guide you through this important purchase. Call us today for more information and free pre-approval. It’s important to know your price range, how much you can afford to buy with confidence and stay focused throughout the process. Whatever your situation, we have solutions for you and can help you realize your real estate dreams.

We take a unique approach to guide you in your first home in a complete and clear way. We will work together to help you understand all aspects of the home buying approach while benefiting from the best interest rates on the market.

Most people spend a considerable amount of time rate shopping for their initial mortgage however that is usually not the case when mortgages come up for maturity. In today’s hectic world people often omit proper consideration at the time of renewal costing them thousands of extra dollars. In fact, it is said nearly 60% of borrowers simply sign and send back their renewal that is first offered to them by their existing lender without even shopping around for a better rate.

Before hearing from your lender have your licensed mortgage professional do the shopping for you. We deal with multiple lending institutions including major banks, credit unions and trusts etc. which means we can put significant negotiating power in your hands and save you lots of money. Ideally contact our team members four to six months prior to your mortgage expiring to have ample time to find the best solution, product and rate for your needs.

With interest rates still historically low, there is no better time than now to buy your first home. Let our dedicated team of mortgage brokers guide you through this important purchase. Call us today for more information and free pre-approval. It’s important to know your price range, how much you can afford to buy with confidence and stay focused throughout the process. Whatever your situation, we have solutions for you and can help you realize your real estate dreams.

We take a unique approach to guide you in your first home in a complete and clear way. We will work together to help you understand all aspects of the home buying approach while benefiting from the best interest rates on the market.

Most people spend a considerable amount of time rate shopping for their initial mortgage however that is usually not the case when mortgages come up for maturity. In today’s hectic world people often omit proper consideration at the time of renewal costing them thousands of extra dollars. In fact, it is said nearly 60% of borrowers simply sign and send back their renewal that is first offered to them by their existing lender without even shopping around for a better rate.

Before hearing from your lender have your licensed mortgage professional do the shopping for you. We deal with multiple lending institutions including major banks, credit unions and trusts etc. which means we can put significant negotiating power in your hands and save you lots of money. Ideally contact our team members four to six months prior to your mortgage expiring to have ample time to find the best solution, product and rate for your needs.

There are many reasons why refinancing your home may be a good option for you. Why not use the equity available in your home to consolidate debts and pay off credit card or other high interest loans and lines of credit. With low mortgage interest rates there is no better time to take advantage of getting your finances in order and consolidating all to one easy monthly payment leaving you with extra money to invest or make those much needed home improvements.

Contact us today so that one of our representatives can review your file and show you how refinancing may help you save money.

Just because you are a new immigrant or a Non Resident and have no prior financial history in this country, it does not mean you need to wait to purchase a home. We have multiple solutions available for clients in all situations. Call us today, with access to multiple lenders we’ll help find the right product for you.

With real estate being one of the safest and most attractive investment categories in Canada for the past decade, we understand your desire to want to invest and purchase investment properties and multi-residential units. We are able to finance a simple investment condo to a 100-200 unit multi-residential buildings. Please call us for all financing requests. Our team is here to explore new options and great rates available to you.

There are many reasons why refinancing your home may be a good option for you. Why not use the equity available in your home to consolidate debts and pay off credit card or other high interest loans and lines of credit. With low mortgage interest rates there is no better time to take advantage of getting your finances in order and consolidating all to one easy monthly payment leaving you with extra money to invest or make those much needed home improvements.

Contact us today so that one of our representatives can review your file and show you how refinancing may help you save money.

Just because you are a new immigrant or a Non Resident and have no prior financial history in this country, it does not mean you need to wait to purchase a home. We have multiple solutions available for clients in all situations. Call us today, with access to multiple lenders we’ll help find the right product for you.

With real estate being one of the safest and most attractive investment categories in Canada for the past decade, we understand your desire to want to invest and purchase investment properties and multi-residential units. We are able to finance a simple investment condo to a 100-200 unit multi-residential buildings. Please call us for all financing requests. Our team is here to explore new options and great rates available to you.

Being self-employed has not always made obtaining a mortgage easy with top-tier banks. Often a major bank’s mortgage representative will not take the proper time or have the knowledge to treat these files with the experience necessary. Orbis Mortgage Group and its brokers have access to a wide array of both A and alternative lenders who can offer great self-employed and stated income programs. Our goal is to make it easier than ever to obtain a mortgage while ensuring you have the best rate on the market for your situation. You can now enjoy the income and credit flexibility that accompanies owning a business all the while qualifying for maximum personal lending. Whether you’re the owner of a corporation or a small family owned business, these lenders understand that self-employed consumers have tax deductions and income is subject to a reasonability test. Let our team help guide and find solutions regardless of your situation.

Your Orbis Mortgage Broker can evaluate your current mortgage needs and determine whether your current mortgage offering is still the best fit for you. We can shop around and find alternatives that may better meet your needs and save you money.

Whether you are looking to make some much-needed repairs, build an extension for your growing family or add a swimming pool to your backyard, home renovations can help you enjoy your current home and possibly even increase its resale value. Many Canadians have taken advantage of the equity in their current home and low mortgage rates to borrow leaving them with the money they need to undertake such projects. Contact our team today to discuss how you too can access the funds you need for the renovations and home improvements you have been dreaming of.

Being self-employed has not always made obtaining a mortgage easy with top-tier banks. Often a major bank’s mortgage representative will not take the proper time or have the knowledge to treat these files with the experience necessary. Orbis Mortgage Group and its brokers have access to a wide array of both A and alternative lenders who can offer great self-employed and stated income programs. Our goal is to make it easier than ever to obtain a mortgage while ensuring you have the best rate on the market for your situation. You can now enjoy the income and credit flexibility that accompanies owning a business all the while qualifying for maximum personal lending. Whether you’re the owner of a corporation or a small family owned business, these lenders understand that self-employed consumers have tax deductions and income is subject to a reasonability test. Let our team help guide and find solutions regardless of your situation.

Your Orbis Mortgage Broker can evaluate your current mortgage needs and determine whether your current mortgage offering is still the best fit for you. We can shop around and find alternatives that may better meet your needs and save you money.

Whether you are looking to make some much-needed repairs, build an extension for your growing family or add a swimming pool to your backyard, home renovations can help you enjoy your current home and possibly even increase its resale value. Many Canadians have taken advantage of the equity in their current home and low mortgage rates to borrow leaving them with the money they need to undertake such projects. Contact our team today to discuss how you too can access the funds you need for the renovations and home improvements you have been dreaming of.

At Orbis Mortgage Group we are able to look at your dream and find a solution to make it happen. Please contact us to go through your specific wants and we will ensure a smooth process to acquiring the perfect property.

The Major Banks only cater to specific ‘A’ clients and do not offer options to clients who have short term difficulties. It can be a credit problem, income problem or other difficulties, we are here to find the best option at the cheapest rate for your specific situation. Orbis Mortgage Group has experience in all of these situations, just give us a call!

At Orbis Mortgage Group we can help you walk through your plan of how to finance the construction of your dream home. Many institutions have different programs and we are here to guide you to them. Please call us to discuss your specific plan.

At Orbis Mortgage Group we are able to look at your dream and find a solution to make it happen. Please contact us to go through your specific wants and we will ensure a smooth process to acquiring the perfect property.

The Major Banks only cater to specific ‘A’ clients and do not offer options to clients who have short term difficulties. It can be a credit problem, income problem or other difficulties, we are here to find the best option at the cheapest rate for your specific situation. Orbis Mortgage Group has experience in all of these situations, just give us a call!

At Orbis Mortgage Group we can help you walk through your plan of how to finance the construction of your dream home. Many institutions have different programs and we are here to guide you to them. Please call us to discuss your specific plan.